Automotive Insurance Quote Trends in Saudi Arabia – What’s Changing? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The topic delves into the importance of monitoring insurance quote trends in the automotive industry, shedding light on the factors driving changes in Saudi Arabia's automotive insurance landscape.

Introduction to Automotive Insurance Quote Trends in Saudi Arabia

Monitoring and understanding insurance quote trends in the automotive industry is crucial for both consumers and insurance providers. These trends can impact the cost of insurance premiums, coverage options, and overall competitiveness in the market.

Factors Influencing Changes in Automotive Insurance Quotes

- Economic Conditions: Fluctuations in the economy can affect insurance rates as insurers adjust to market conditions.

- Regulatory Changes: Updates in regulations and laws related to insurance can impact pricing and coverage options.

- Technological Advances: Innovations in the automotive industry, such as new safety features, can influence insurance costs.

- Claims History: The frequency and severity of claims can impact insurance quotes for both individual drivers and the overall market.

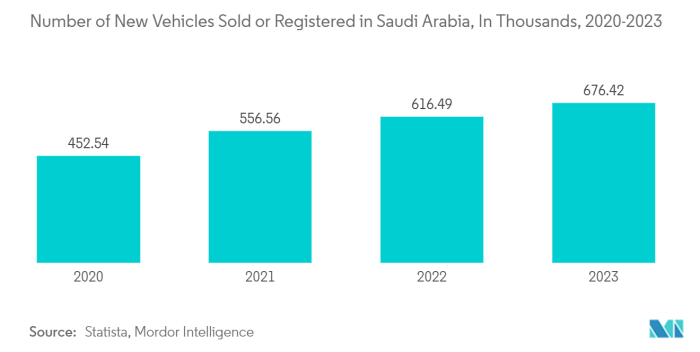

Current Landscape of Automotive Insurance in Saudi Arabia

In Saudi Arabia, the automotive insurance sector is experiencing growth and evolution due to regulatory reforms and market dynamics. The introduction of mandatory insurance requirements and the emergence of digital insurance platforms have reshaped the industry.

Technology Impact on Automotive Insurance Quotes

Technology has played a significant role in shaping the automotive insurance landscape in Saudi Arabia. Advancements in various technologies have revolutionized the process of generating insurance quotes, making it more efficient and accurate for both insurance providers and car owners.

Role of Telematics in Determining Insurance Premiums

Telematics, which involves the use of devices to monitor and collect data on driving behavior, has emerged as a key factor in determining insurance premiums. By analyzing data such as speed, acceleration, braking, and cornering, insurance companies can assess the risk profile of individual drivers more accurately.

This data-driven approach allows for personalized pricing based on actual driving habits, incentivizing safer driving practices among policyholders.

Impact of AI and Data Analytics

Artificial intelligence (AI) and data analytics have also played a crucial role in refining the process of generating insurance quotes. By leveraging AI algorithms and advanced analytics tools, insurance providers can analyze vast amounts of data to assess risk factors, predict claim likelihood, and optimize pricing strategies.

This data-driven approach not only enhances underwriting accuracy but also enables insurers to offer competitive premiums tailored to individual risk profiles.

Simplification Through Digital Platforms

The proliferation of digital platforms has simplified the process of obtaining insurance quotes for car owners in Saudi Arabia. Online portals and mobile applications allow customers to compare quotes from multiple insurers, customize coverage options, and purchase policies with ease.

Additionally, digital platforms enable real-time communication with insurance providers, facilitating quick resolution of queries and claims processing. This digital transformation has made the insurance purchasing journey more convenient and transparent for consumers.

Regulatory Changes and Their Influence

In Saudi Arabia, recent regulatory changes have significantly impacted automotive insurance quotes, leading to shifting trends in pricing. These updates have brought about new requirements for insurance companies, ultimately influencing the cost of insurance for vehicle owners.

New Regulatory Requirements

- One of the key regulatory changes affecting automotive insurance quotes in Saudi Arabia is the implementation of mandatory medical insurance for drivers. This requirement has led to an increase in overall insurance costs, as insurers now need to account for medical coverage in their policies.

- Another important update is the introduction of a unified motor insurance policy, aimed at streamlining the insurance process and ensuring greater transparency for consumers. While this may lead to more standardized pricing, it also brings about changes in how insurance quotes are calculated and offered.

Impact on Insurance Pricing

- These regulatory changes have had a direct impact on the pricing of automotive insurance quotes in Saudi Arabia. With the addition of medical insurance and the implementation of a unified policy, insurers have had to adjust their pricing models to accommodate these new requirements.

- Compliance with the updated regulations has also required insurance companies to invest in technology and infrastructure to meet the new standards. This investment may have contributed to changes in how quotes are generated and the factors considered in pricing policies.

Consumer Behavior and Preferences

Consumer behavior and preferences play a crucial role in shaping the demand for specific types of insurance coverage. Understanding what factors influence consumers when comparing and choosing insurance quotes is essential for insurance providers to tailor their offerings effectively. Let's delve into the various aspects of consumer behavior and preferences in the automotive insurance market in Saudi Arabia.

Factors Influencing Consumer Choices

- Price: Cost remains a significant factor for consumers when selecting insurance coverage. Many consumers compare quotes to find the most affordable option that meets their needs.

- Coverage Options: Consumers look for insurance policies that provide comprehensive coverage for their vehicles. Factors such as coverage limits, deductibles, and additional benefits influence their decision-making process.

- Customer Service: The quality of customer service provided by insurance companies can sway consumer preferences. Quick claims processing, transparent communication, and responsive support are valued by customers.

- Reputation and Trust: Consumers often consider the reputation and reliability of insurance providers before making a decision. Positive reviews, recommendations, and brand trust can impact their choice.

Personalized Insurance Solutions

Insurance providers are increasingly focusing on offering personalized insurance solutions tailored to individual consumer needs. By leveraging data analytics and technology, insurers can create customized policies that align with specific preferences and requirements.

Shift towards Digital Channels

- Many consumers in Saudi Arabia are now turning to digital channels to obtain insurance quotes and purchase policies. The convenience of online platforms and mobile apps has influenced consumer behavior, leading to a significant shift towards digital interactions.

- Insurers are investing in user-friendly interfaces and digital tools to enhance the customer experience. Features such as online quote calculators, instant policy issuance, and digital claims processing are becoming increasingly popular among tech-savvy consumers.

Market Competition and Pricing Strategies

In the automotive insurance sector of Saudi Arabia, market competition plays a significant role in shaping pricing strategies adopted by insurance providers. This competition often leads to fluctuations in insurance quotes, as companies strive to attract and retain customers through various pricing tactics.

Comparison of Pricing Strategies

- Some insurance providers in Saudi Arabia may focus on offering competitive base rates to attract price-sensitive customers.

- Others may emphasize value-added services, such as roadside assistance or bundled insurance packages, to justify higher premiums.

- Certain insurers might target specific customer segments, such as young drivers or luxury car owners, with tailored pricing and coverage options.

Impact of Market Competition

- Market competition creates pressure on insurance companies to adjust their pricing strategies to remain competitive.

- Intense competition can lead to price wars among insurers, resulting in lower premiums for consumers.

- However, aggressive pricing strategies may also impact the profitability and sustainability of insurance providers in the long run.

Role of Discounts and Incentives

- Insurance companies often offer discounts for safe driving records, multiple policy bundles, or loyalty programs to attract and retain customers.

- Promotional offers, such as cashback rewards or free add-ons, can influence consumer decisions when choosing an insurance provider.

- Incentives like no-claim bonuses or referral rewards encourage policyholders to maintain a long-term relationship with the insurer.

Impact of Economic Conditions

In Saudi Arabia, economic factors such as GDP growth, inflation, and unemployment rates play a significant role in shaping the automotive insurance landscape. These variables directly impact insurance pricing, consumer behavior, and the overall affordability of insurance premiums.

Correlation between Economic Conditions and Insurance Pricing

Economic conditions have a direct impact on insurance pricing in Saudi Arabia. For instance, during periods of high inflation, insurance companies may increase premiums to offset rising costs. Similarly, a decrease in GDP growth or a spike in unemployment rates can lead to higher insurance rates as insurers adjust for increased risk in the market.

- Insurance companies closely monitor economic indicators to assess the overall financial health of the country and its impact on the insurance industry.

- Fluctuations in economic conditions can result in changes in consumer purchasing power, affecting the demand for insurance products.

- During economic downturns, insurers may face challenges as policyholders reassess their insurance needs and prioritize essential expenses.

Affordability of Automotive Insurance

The correlation between economic conditions and the affordability of automotive insurance is crucial for consumers in Saudi Arabia. When economic indicators are favorable, insurance premiums may be more affordable for policyholders. However, during economic downturns, factors such as inflation and unemployment can strain household budgets, making insurance premiums less affordable.

- Insurance companies may offer flexible payment options or discounts during economic hardships to make insurance more accessible to consumers.

- Government interventions or regulatory measures can also impact insurance affordability, especially during periods of economic instability.

- Consumer education on insurance coverage and cost-saving measures becomes essential during challenging economic times.

Resilience of the Insurance Industry

Despite the challenges posed by economic fluctuations, the insurance industry in Saudi Arabia has demonstrated resilience during economic downturns. Insurers adapt to changing market conditions by implementing risk management strategies, adjusting pricing models, and diversifying their product offerings to remain competitive.

- Investment income, underwriting practices, and reinsurance arrangements play a crucial role in safeguarding insurers against economic uncertainties.

- The regulatory framework in Saudi Arabia ensures stability and transparency in the insurance market, contributing to the industry's resilience during economic challenges.

- Collaboration between insurance companies, government entities, and industry stakeholders helps mitigate risks and enhance the industry's ability to weather economic storms.

Final Wrap-Up

In conclusion, the changing dynamics of automotive insurance quote trends in Saudi Arabia reflect a complex interplay of technological advancements, regulatory influences, consumer behaviors, market competition, and economic conditions. As the industry continues to evolve, staying informed and adapting to these transformations will be key for both insurers and policyholders.

Question & Answer Hub

What factors influence changes in automotive insurance quotes in Saudi Arabia?

The factors include technological advancements, regulatory updates, consumer preferences, market competition, and economic conditions.

How have advancements in technology affected the process of generating insurance quotes in Saudi Arabia?

Technological advancements have streamlined the process, with tools like telematics, AI, and data analytics playing a significant role in determining insurance premiums.

What recent regulatory changes in Saudi Arabia have impacted automotive insurance quotes?

Recent regulatory changes include updates in compliance requirements for insurance companies, which contribute to the shifting trends in insurance pricing.