Exploring Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this introductory paragraph aims to grab the readers' attention and provide a sneak peek into the valuable information that follows.

Delving deeper into the intricacies of high-risk drivers and how they can navigate the world of car insurance efficiently.

Factors Affecting High-Risk Drivers

When it comes to determining insurance rates for high-risk drivers in Canada, several factors play a crucial role. One of the primary factors that significantly impact insurance premiums is the driver's record behind the wheel. Let's delve deeper into the various elements that influence insurance costs for high-risk drivers.

Driving Record and Insurance Rates

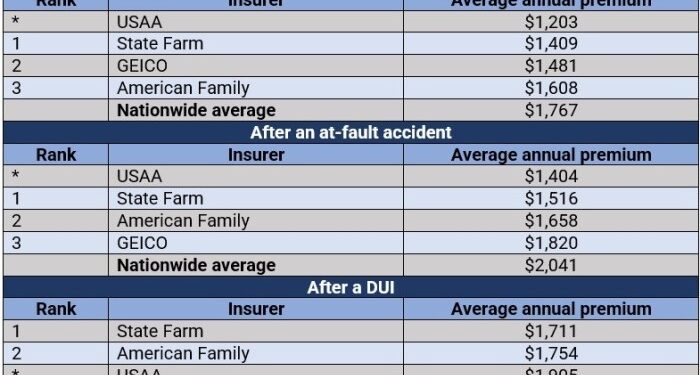

A high-risk driver's driving record is a key determinant in calculating insurance premiums. Drivers with a history of accidents, traffic violations, or multiple claims are considered riskier to insure, leading to higher insurance rates. Insurance companies assess the level of risk associated with a driver's past behavior on the road, making it essential for high-risk drivers to work on improving their driving record to potentially lower their insurance costs.

Age, Vehicle Type, and Location

In addition to driving record, other factors such as age, vehicle type, and location also play a significant role in determining insurance premiums for high-risk drivers. Younger drivers are often considered riskier to insure compared to older, more experienced drivers.

The type of vehicle being insured and the location where the driver resides can also impact insurance costs. Sports cars or vehicles with high theft rates may lead to higher premiums, as well as living in areas with a higher frequency of accidents or theft.

Impact of Multiple Claims and Traffic Violations

High-risk drivers with a history of multiple claims and traffic violations are likely to face increased insurance premiums. Insurance companies view drivers who have made several claims or have a record of traffic violations as higher risks, resulting in higher insurance costs to offset the potential financial risks associated with insuring these individuals.

It is essential for high-risk drivers to maintain a clean driving record and be mindful of their behavior on the road to potentially lower their insurance rates.

Understanding High-Risk Insurance

High-risk car insurance is designed for drivers who are considered more likely to be involved in accidents or file claims. These drivers are classified as high-risk due to various factors such as a history of accidents, traffic violations, DUI convictions, or poor credit scores.

Regular car insurance typically offers lower premiums and broader coverage options to drivers with a clean driving record and low-risk profile. On the other hand, high-risk insurance may come with higher premiums, deductibles, and limited coverage options to offset the increased risk associated with insuring these drivers.

Situations that Classify a Driver as High-Risk

- Multiple at-fault accidents within a short period

- History of traffic violations or speeding tickets

- Driving under the influence (DUI) convictions

- Poor credit score

- Young or inexperienced drivers

Comparison of Regular Car Insurance vs. High-Risk Insurance

Regular car insurance:

- Lower premiums

- Broader coverage options

- Discounts for safe driving

High-risk insurance:

- Higher premiums

- Limited coverage options

- Higher deductibles

Tips for Getting Discount Car Insurance Quotes

When it comes to high-risk drivers looking for discount car insurance quotes, there are specific strategies that can help lower insurance premiums and save money in the long run. Shopping around for quotes from different insurance companies and completing a defensive driving course can both play a significant role in securing lower rates.

Strategies to Lower Insurance Premiums

- Consider increasing your deductible: Opting for a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expenses in case of an accident.

- Bundle your policies: Combining your car insurance with other policies like home or renters insurance can often lead to discounts.

- Drive a safer vehicle: Some cars are cheaper to insure than others. Choosing a vehicle with a high safety rating can help reduce your insurance costs.

Shopping Around for Quotes

- Don't settle for the first quote you receive: Compare prices from multiple insurance companies to ensure you're getting the best deal.

- Utilize online comparison tools: Websites that allow you to compare quotes from different insurers can make the process easier and more efficient.

Defensive Driving Course Discounts

Completing a defensive driving course can demonstrate to insurance companies that you are a responsible driver, potentially leading to discounts on your premiums

Utilizing Discounts and Savings

Utilizing discounts and savings is crucial for high-risk drivers in Canada to manage their car insurance costs effectively. By taking advantage of available discounts and savings opportunities, drivers can significantly reduce their insurance premiums and make their coverage more affordable.

Common Discounts for High-Risk Drivers

- Safe driving discounts for maintaining a clean driving record

- Multi-vehicle discounts for insuring more than one vehicle

- Low mileage discounts for driving fewer kilometers

- Discounts for completing a defensive driving course

- Discounts for installing anti-theft devices in your vehicle

Bundling Home and Auto Insurance for Savings

Bundling your home and auto insurance policies with the same provider can lead to significant savings. Insurance companies often offer discounts to customers who choose to bundle their policies, making it a cost-effective option for high-risk drivers. By consolidating your insurance needs with one provider, you can potentially save money on both policies.

Maximizing Savings through Loyalty Programs and Good Driving Discounts

- Enroll in loyalty programs offered by insurance companies to earn discounts over time

- Take advantage of good driving discounts for maintaining a safe driving record

- Consider usage-based insurance programs that reward safe driving habits

- Regularly review your policy and coverage to ensure you are getting all available discounts

Comparison of Insurance Providers

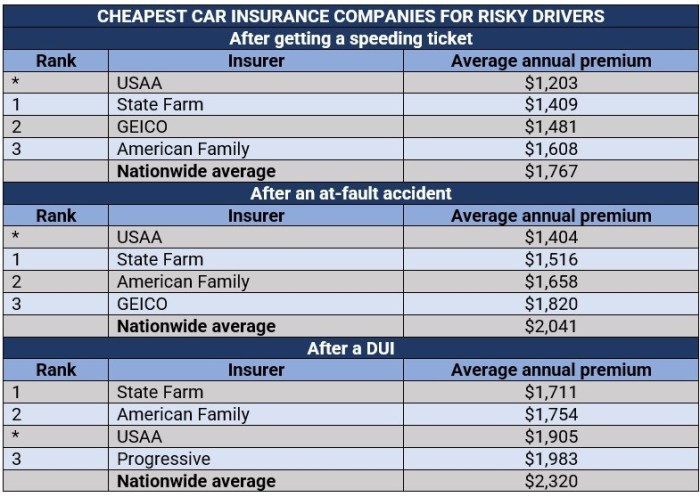

When it comes to finding car insurance as a high-risk driver in Canada, comparing insurance providers is crucial to ensure you get the best coverage at the most affordable rates.

Insurance Providers in Canada

- Start by researching insurance companies in Canada that specialize in providing coverage for high-risk drivers.

- Obtain quotes from multiple insurance providers to compare rates, coverage options, and discounts offered.

- Consider factors such as customer service, claims process efficiency, and overall reputation when evaluating insurance companies.

Obtaining and Comparing Quotes

- Reach out to different insurance providers to request quotes based on your specific high-risk driver profile.

- Compare the quotes received in terms of coverage limits, deductibles, premiums, and any additional benefits or discounts offered.

- Take note of any exclusions or limitations in the policies to make an informed decision.

Customer Reviews and Satisfaction Ratings

- Read customer reviews and testimonials to gauge the overall satisfaction levels of policyholders with different insurance providers.

- Look for ratings and reviews on independent websites or consumer advocacy platforms to get unbiased opinions.

- Consider feedback on the claims process, customer service quality, and overall experience when choosing an insurance company.

Last Recap

Wrapping up the discussion on Discount Car Insurance Quotes: Tips for High-Risk Drivers in Canada, this concluding paragraph encapsulates the key points discussed and leaves the readers with food for thought.

Questions Often Asked

What factors impact insurance rates for high-risk drivers?

Driving record, age, vehicle type, and location are key factors influencing insurance costs for high-risk drivers.

How can high-risk drivers lower insurance premiums?

High-risk drivers can reduce premiums by shopping around for quotes, completing defensive driving courses, and taking advantage of available discounts.

What are some common discounts for high-risk drivers in Canada?

Common discounts include bundling home and auto insurance, loyalty programs, and discounts for good driving behavior.