Delving into Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India), this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

When it comes to shopping for car insurance, comparing quotes from different countries like the US, UK, and India can provide valuable insights into the variations in coverage, premiums, and regulations. This comparison allows individuals to make informed decisions based on a broader perspective, ensuring they choose the most suitable car insurance policy for their needs.

Overview of Car Insurance Quotes Comparison

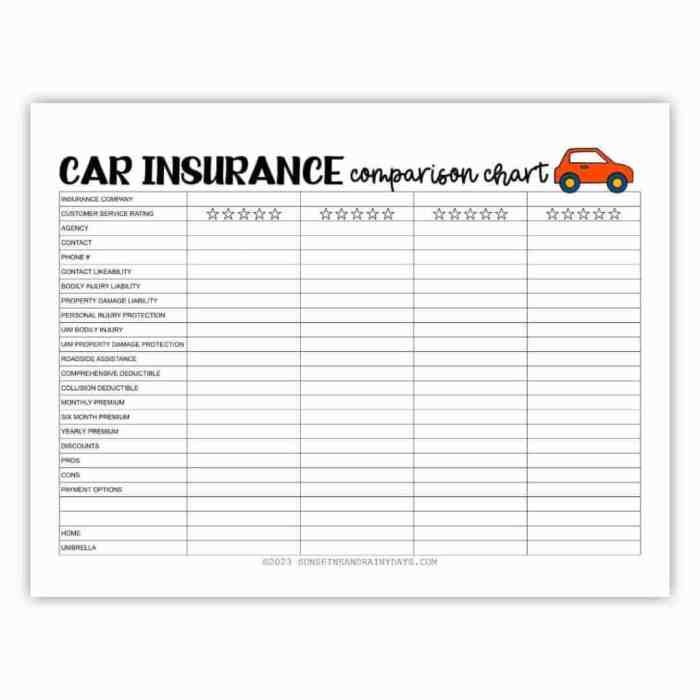

Car insurance quotes are estimates of the cost of insuring a vehicle based on various factors such as the driver's age, driving history, location, and the type of car being insured. Comparing quotes from different insurance providers allows individuals to find the best coverage at the most competitive price.

Comparing car insurance quotes from different countries is important for individuals who may be moving or traveling between countries. Each country has its own insurance regulations, coverage options, and pricing structures, so it is essential to understand these differences before choosing a policy.

Comparison between the US, UK, and India

In this comparison, we will explore the key differences in car insurance quotes between the United States, the United Kingdom, and India. Each country has unique factors that influence insurance pricing and coverage, making it crucial for consumers to be informed about their options.

Factors Affecting Car Insurance Premiums

When it comes to car insurance premiums, there are several factors that can influence the cost in different countries. Demographics, driving history, vehicle type, credit scores, location, and coverage options all play a significant role in determining how much you'll pay for car insurance.

Demographics

Demographics such as age, gender, and marital status can impact car insurance premiums. For example, younger drivers typically pay more for insurance due to their lack of driving experience and higher risk of accidents.

Driving History

A driver's past driving record, including any accidents or traffic violations, can affect insurance premiums. A clean driving history usually leads to lower premiums, while a history of accidents or violations may result in higher costs.

Vehicle Type

The type of vehicle you drive can also impact your insurance premiums. Factors such as the make and model of the car, its age, safety features, and likelihood of theft all play a role in determining how much you'll pay for insurance.

Credit Scores

In some countries, credit scores can affect car insurance premiums. A higher credit score is often associated with lower insurance rates, as it is seen as an indicator of financial responsibility.

Location

Where you live can also impact your car insurance premiums. Urban areas with higher rates of accidents or theft may result in higher premiums compared to rural areas with lower risk factors.

Coverage Options

The coverage options you choose, such as liability, collision, and comprehensive coverage, can also affect your insurance premiums. More coverage typically means higher premiums, but it also provides greater protection in the event of an accident or theft.

Car Insurance Regulations and Requirements

Car insurance regulations vary from country to country, impacting the coverage options and premiums available to drivers. Understanding the legal requirements for car insurance is crucial for all drivers to ensure compliance with the law and adequate protection in case of accidents.

United States

In the United States, car insurance is mandatory in almost all states. Each state has its own minimum liability coverage requirements that drivers must meet to legally operate a vehicle. Additionally, some states may require uninsured/underinsured motorist coverage. Failure to maintain the required insurance coverage can result in fines, license suspension, or vehicle impoundment.

United Kingdom

In the UK, car insurance is also a legal requirement for all drivers. The minimum insurance requirement is third-party liability insurance, which covers damage to other people's vehicles or property. Comprehensive insurance, which covers damage to your own vehicle as well, is optional but highly recommended.

Driving without insurance in the UK can lead to hefty fines, license points, and even vehicle seizure.

India

In India, the Motor Vehicles Act of 1988 mandates that all vehicles on the road must have at least third-party liability insurance. This insurance covers the legal liability of the driver in case of bodily injury, death, or property damage to a third party.

While third-party insurance is compulsory, drivers can also opt for comprehensive coverage for additional protection. Failure to have valid insurance in India can lead to fines, vehicle confiscation, or even imprisonment.

Comparison of Insurance Providers

When it comes to car insurance providers, it is essential to compare the offerings of popular companies in the US, UK, and India to make an informed decision

Popular Car Insurance Providers

In the US, some popular car insurance providers include State Farm, GEICO, Progressive, and Allstate. In the UK, companies like Aviva, Direct Line, Admiral, and Churchill are well-known. In India, players such as ICICI Lombard, New India Assurance, HDFC ERGO, and Bajaj Allianz are prominent in the market.

Types of Coverage and Discounts

Each insurance provider offers different types of coverage, including liability, collision, comprehensive, and more. Discounts such as safe driver discounts, multi-policy discounts, and good student discounts can vary among insurers. It is essential to compare these offerings to find the best fit for your needs.

Customer Service and Reputation

Customer service is a crucial aspect of any insurance provider. Companies with a reputation for excellent customer service are likely to provide a better experience for policyholders. Additionally, the reputation and financial stability of insurers can influence the quotes they offer.

It is important to choose a provider with a strong financial standing to ensure they can fulfill their obligations in case of a claim.

Online Tools for Comparing Quotes

When it comes to comparing car insurance quotes in different countries, online tools have made the process much more convenient for consumers. These platforms allow users to easily input their information and receive multiple quotes from different insurance providers, all in one place.

One of the key benefits of using online tools for comparing quotes is the time-saving aspect. Instead of contacting each insurance company individually or visiting multiple websites, users can simply enter their details once and get a comprehensive list of quotes to compare side by side.

User Experience and Accuracy

- Online tools provide a user-friendly interface that makes it easy for consumers to input their information and preferences.

- These tools often use algorithms to generate accurate quotes based on the data provided, ensuring that users receive realistic estimates of their potential premiums.

- Users can customize their search criteria, such as coverage options and deductibles, to see how different choices impact the cost of their insurance.

Cultural Attitudes Towards Car Insurance

Car insurance is not just a financial product but also reflects cultural attitudes towards risk, responsibility, and protection in different societies. Let's delve into how cultural norms shape the perception of car insurance in the US, UK, and India.

United States

In the US, car insurance is viewed as a necessary safeguard against unforeseen events. Americans tend to prioritize individual responsibility and protection, leading to a high level of insurance coverage. The culture of litigation in the US also influences the emphasis on comprehensive coverage to mitigate legal risks.

United Kingdom

In the UK, car insurance is mandated by law, fostering a culture of compliance and responsibility. British drivers often see insurance as a legal obligation rather than a personal choice. The UK's robust regulatory framework ensures that insurance plays a central role in ensuring financial security and protection for all road users.

India

In India, car insurance is often perceived as an additional expense rather than a fundamental necessity. Cultural attitudes towards risk may vary, with some individuals opting for minimum coverage to meet legal requirements. However, as awareness of the benefits of insurance grows, especially in urban areas, there is a shift towards viewing car insurance as a vital tool for financial protection.

Final Wrap-Up

In conclusion, exploring the nuances of car insurance quotes across multiple countries sheds light on the diverse factors influencing premiums, regulations, and coverage options. By understanding these differences, individuals can navigate the complex world of car insurance with confidence and make well-informed choices to protect their vehicles and finances.

General Inquiries

What are the key factors to consider when comparing car insurance quotes across different countries?

When comparing car insurance quotes, it's important to look at factors such as coverage options, premiums, regulations, and the reputation of insurance providers in each country. These elements can vary significantly and impact the overall quality of the insurance policy.

Are there specific coverage types mandated by law in the US, UK, and India?

Yes, each country has its own legal requirements for car insurance coverage. For example, in the US, liability insurance is mandatory, while the UK requires third-party insurance. India mandates third-party liability insurance for all vehicles.

How do cultural attitudes influence the perception of car insurance in different countries?

Cultural attitudes play a significant role in how car insurance is viewed. For instance, in the US, car insurance is seen as a necessary financial protection, while in India, it's often viewed as a legal obligation. These perceptions can impact insurance decisions and coverage choices.